Forget “new.” The cult of the new is a trap. It’s a loop designed to keep you consuming, not building. Our path has never been about what we can buy. It’s about what we can create, sustain, and pass on.

Buying used isn’t a compromise. It’s a declaration of independence. It’s the recognition that value isn’t manufactured in a factory this quarter; it’s proven over decades. It’s the understanding that our capital is too precious to be burned on depreciation. It must be strategically reallocated—toward assets, toward knowledge, toward sovereignty.

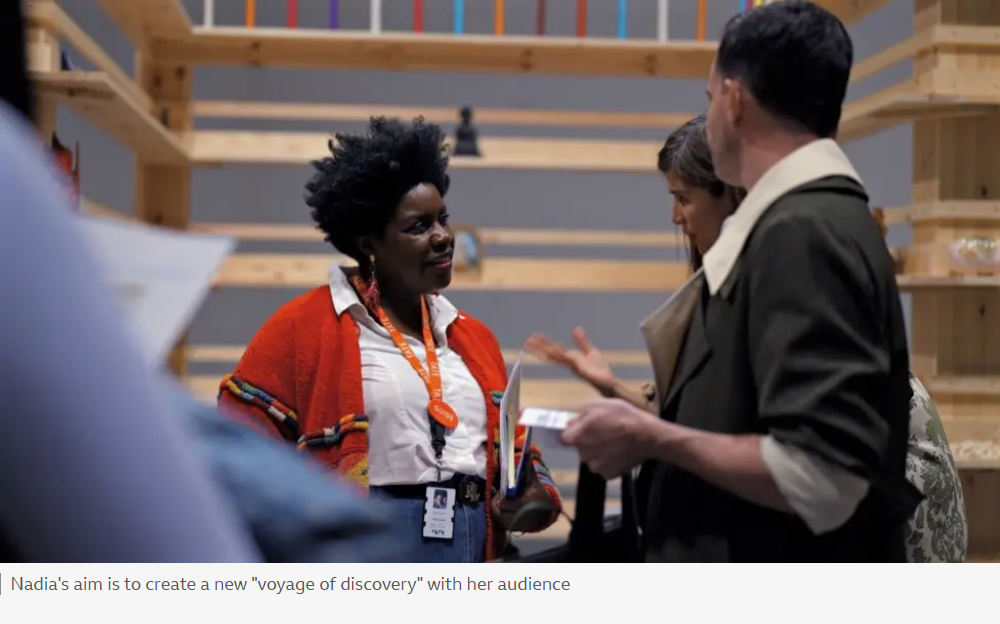

Here is the Afro-Futurist framework for resource allocation. This isn’t about being cheap. This is about being strategic.

1. Books: Curate Your Archive, Don’t Consume Their Catalog

A book is a vessel. A used book is a vessel that has already traveled. The notes in the margin are data points. The cracked spine is a history. Your library should not be a display of purchasing power. It should be a living archive of applied thought. Paying $30 for a new hardcover funds a marketing budget. Paying $4 at a library sale funds your own intellectual sovereignty. Invest the difference in the knowledge itself.

2. Tools: Your Hands Build Worlds. Arm Them Wisely.

They want you to buy flimsy tools that break. A broken tool creates a recurring customer. A used DeWalt drill from 1995 is not old; it is battle-tested. Our legacy is one of building—from the craftspeople of the Harlem Renaissance to the engineers of the Afrofuturist aesthetic. Your toolkit is an extension of that legacy. Buy the proven steel. Let someone else pay for the first cycle of failure.

3. Furniture: Anchor Your Space in Time, Not Trends.

Fast furniture is cultural amnesia—particle board with no memory. A solid oak table from an estate sale has weight. It has history. It has gravity. Refinishing it isn’t a chore; it’s a ritual of reclamation. You are not decorating a room. You are establishing a base of operations with materials meant to outlive you.

4. Capital Equipment: Capture Depreciation, Don’t Fund It.

Cars, exercise machines, industrial gear. These are not products. They are depreciating capital assets. Let the impatient pay the steepest price of ownership—the immediate value vaporized the moment it leaves the lot. You are not a consumer; you are a capital strategist. Buy the asset after its value has been rationally reset. Deploy the saved capital into something that appreciates.

5. Children’s Goods: Build Their Future, Don’t Furnish Their Present.

Children outgrow things. This is not a flaw; it is a feature. It is a built-in cycle of renewal. Pouring money into new clothes they will shed in months is a distraction of resources. That capital should be flowing into their 529 plan, their first SAT prep book, the down payment on a property they will inherit. Clothe them practically. Invest in their future absolutely.

The Guiding Principle: The Sankofa Allocation

This is the Sankofa Principle applied to finance: look back to move forward wisely. The past is full of high-quality, depreciated assets. The future is built with preserved capital.

Do not buy used to save money. Buy used to reallocate capital. The $10,000 you save on the car is the seed for a rental property. The $500 you save on tools is a position in a crypto asset. The $200 you save on books is a contribution to a community investment DAO.

Stop feeding the machine of newness. Start building the archive of your own legacy.

Stop feeding the machine of newness. Start building the archive of your own legacy.

This is how we engineer freedom. Not with a single check, but with a thousand strategic reallocations.

6. Sports & Recreational Gear: Master the Craft, Not the Purchase.

High-performance gear is a tool for mastery, not a badge of participation. The market is flooded with barely-used equipment from abandoned aspirations. Your goal is not to look like a golfer or cyclist, but to become one. Let someone else fund the initial 80% depreciation on the latest driver or carbon frame. You acquire the proven instrument and invest the thousands saved into actual training, coaching, and time to practice. Skill appreciates. Gear depreciates. Allocate accordingly.

7. Media (Games, Films, Music): Consume Culture, Not Hype.

A new video game at $70 is a tax on impatience. The art is identical six months later at $25. The same principle applies to films and music. We are curators of culture, not hostages to release-day marketing. Use the gap between hype and value as a financial airlock. Preserve your capital from the rapid depreciation of digital novelty. Let the crowd fund the advertising campaign. You will meet the art later, on your terms, with your resources intact.

8. Textbooks & Educational Material: Own the Knowledge, Not the Monopoly.

The textbook industry is a rent-seeking operation against your own advancement. New editions are minor updates with major price tags, designed to invalidate the used market. Refuse this tax. Source the knowledge—the information is what you’re buying, not the glossy paper. Used books, PDFs, library copies, and shared resources are acts of educational insurgency. Redirect every dollar saved into the actual application of that knowledge: a certification exam fee, a professional tool, a conference ticket.

9. Formal & Niche Clothing: Armor for the Role, Not the Mannequin.

A high-quality suit, a specific technical jacket, a designer handbag for certain rooms—these are tools for specific environments. Their value on the secondary market plummets the moment they are no longer “the latest season.” But their functional utility—the warmth, the tailoring, the craftsmanship—remains. Acquire these tools after their status-signal value has been stripped away. Pay for the material and function, not the marketing aura. You need the armor for the battle, not the fashion show.

10. Kitchenware & Appliances: Equip the Laboratory, Not the Showroom.

A professional-grade stand mixer, cast iron cookware, a high-powered blender—these are the instruments of a home laboratory, the place where health and community are literally forged. These items are built to last for decades. Buying them new means paying a premium for the privilege of performing the initial “break-in.” Seek out the already-seasoned, already-proven workhorses. A vintage Le Creuset pot or a commercial KitchenAid mixer has a history of service. It is a reliable partner, ready for your next creation.

The Synthesis: The Sovereign Portfolio

This is not a list of frugal tips. It is a manifesto for capital sovereignty.

Every category follows the same principle:

- Identify the Depreciating Asset (the car, the textbook, the current-season jacket).

- Let the Impatient Pay the Premium for its initial, rapid loss of value.

- Acquire the Proven Tool after its value has been rationally reset.

- Strategically Reallocate the Preserved Capital into an Appreciating Asset (education, property, investments, business capital).

The goal is to flip the script. The mainstream system wants you to constantly spend your principal on depreciating goods. Our strategy is to preserve principal and only spend the yield.

Buying used isn’t how you save money. It’s how you keep your powder dry for the fights that matter.

This is the Afro-Futurist financial model: using the past’s high-quality, depreciated tools to build a future of uncompromised sovereignty.

The revolution isn’t funded with new receipts. It’s built with preserved capital.