The Dollar’s Quiet Upgrade: How RLUSD and XRP Could Extend America’s Global Reign for Another Century

Headlines scream chaos: tariffs spark inflation, Fed pressure rattles markets, the dollar dips while gold surges to records. Citizens feel it—rising costs, confidence lows, the sense that the economy’s taking hits. It looks like a mad scramble.

But zoom out, and a sharper picture emerges: this could be deliberate disruption—a high-stakes pivot to modernize the dollar’s dominance rather than let it fade.

The Fiat Endgame Meets Blockchain Solution

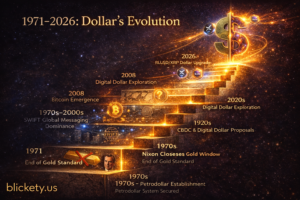

Since Nixon closed the gold window in 1971, the fiat experiment has run on borrowed time. Ron Paul warned for decades: governments know the system’s unsustainable—endless deficits, printing to fund them, inflation as hidden tax—but they’ve ridden it “till the wheels fall off.”

Enter 2026: wheels wobbling hard. BRICS nations now settle over 90% of Russia-India-China trade without dollars, with gold projected to hit $4,000 per ounce as central banks diversify away from USD reserves. Russia and China conduct around 90% of bilateral trade in rubles and yuan, while BRICS Pay expansion has reduced USD usage in intra-bloc trade by roughly two-thirds Africadeeptech.

Yet America’s not surrendering the throne—it’s upgrading the infrastructure.

The RLUSD XRP Dollar Strategy: Extend, Don’t End

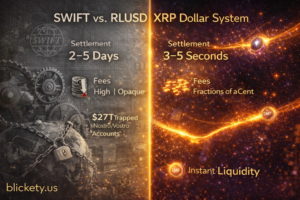

The dollar stays king, but gets a digital lifeline. Ripple’s ecosystem—XRP as the fast, asset-agnostic bridge enabling 3-5 second settlements and RLUSD as the stable, USD-pegged anchor fully backed 1:1 by cash, U.S. Treasuries, and equivalents custodied by BNY Mellon under NYDFS regulation could become the plumbing that keeps cross-border flows dollar-denominated while slashing friction.

RLUSD is the stable on-ramp: Hit $1.26 billion market cap in less than a year, making it the third-largest U.S.-regulated stablecoin positioned for GENIUS Act compliance when federal framework takes effect in 2027. LMAX Group partnership integrates RLUSD as core collateral asset with $150 million financing, enabling institutional clients to use it for enhanced cross-collateralization and margin efficiencies across crypto, perpetual futures, and CFD trading built in.

XRP handles the heavy lifting: The International Monetary Fund recognized XRP as one of three major solutions capable of transforming international payments TRT Afrika, while Japan’s entire banking industry—including Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho—launched coordinated XRP adoption for cross-border payments in January 2026, with full regulatory approval.

Together? Synergy, not competition. RLUSD provides dollar stability for institutions; XRP enables instant, low-cost bridging. This hybrid could capture chunks of the $150T+ annual cross-border market, keeping USD central even as alternatives rise.

Why Now? The “Planned Chaos” Angle

SWIFT’s correspondent banking system ties up an estimated $27 trillion in parked nostro/vostro account liquidity before transactions settle capital that could flow freely. Following August 2025’s SEC settlement ending multi-year litigation, XRP entered a phase of market-driven price discovery, reopening the asset to U.S. institutions, regulated funds, banks, and payment companies previously sidelined due to compliance risks.

Trump’s disruption—tariffs weakening the dollar short-term, Fed pressure for easier money—creates the “pain” that forces repricing. Central banks are amassing gold reserves at a pace not seen in decades, with U.S. debt ballooning to $38 trillion Afrotechconference. Adversaries overcommit to de-dollarization, but the U.S. flips the script: Ripple spent over $2.7 billion on acquisitions including Hidden Road ($1.25B prime broker), Rail ($200M stablecoin payments), and GTreasury, expanding capabilities across payments, settlement, and treasury services.

Pro-crypto policies—CLARITY Act advancing, stablecoin rules solidifying—tee up adoption. Ripple received conditional OCC national bank charter approval in December 2025, allowing operation as federally regulated fiduciary with direct access to Federal Reserve payment systems.

Bitcoin? BTC shines as digital gold—store of value, hedge, strategic reserve . But it won’t sideline XRP. BTC’s for holding wealth; XRP’s for moving it. Different lanes, complementary dominance.

The Bigger Picture for Everyday Life

This isn’t just Wall Street games. RLUSD integration with platforms like Chipper Cash and Yellow Card in Africa tackles currency instability and high transaction costs—Sub-Saharan Africa faces some of the world’s priciest remittance fees, often exceeding 8% when traditional banking fees are the norm.

Faster, cheaper global payments mean lower remittance fees for families, smoother corporate cash flow, more resilient economies. Ripple Payments enables companies to pay employees or contractors in stablecoins like RLUSD with real-time settlement—workers can accept wages directly in stablecoins or convert to local currency using integrated off-ramp partners.

The Afro-Futurist Lens: Who Controls the Rails Controls the Future

Here’s what they won’t tell you: whoever controls payment infrastructure controls economic destiny. SWIFT wasn’t just messaging—it was power. When Russia was removed from SWIFT after Ukraine invasion, BRICS nations accelerated alternative payment systems like mBridge (connecting China, Hong Kong, Thailand, UAE central banks) and BRICS Pay linking Russia’s SPFS, China’s CIPS, India’s UPI Africadeeptech.

But here’s the play: while BRICS builds fragmented alternatives, Ripple CTO David Schwartz notes adoption hinges on usage metrics—transaction volume, liquidity depth, system reliability—not price speculation or political narrative. The XRP Ledger has processed over 4 billion transactions with growing institutional use.

The RLUSD XRP dollar strategy isn’t about fighting de-dollarization—it’s about making dollar rails so efficient that alternatives can’t compete on utility.

Ripple integrated RLUSD directly into Ripple Payments, immediately giving the stablecoin active use in cross-border transfers, remittance corridors, and FX settlement across LATAM, Middle East, Africa, and APAC. This isn’t theoretical—it’s operational infrastructure scaling now.

Risks, Real Talk, and the Road Ahead

Of course, challenges loom: regulatory hurdles, adoption speed, or true crisis if the plan backfires. India’s External Affairs Minister stated: “The dollar as the reserve currency is the source of international economic stability, and right now, what we want in the world is more economic stability, not less,” even BRICS members aren’t united on full de-dollarization.

But in a world where the BRICS New Development Bank aims to conduct 30% of lending in local currencies by 2026, the script feels less chaotic, more calculated.

Eyes on the rails: RLUSD scaling, XRP ETF momentum following regulatory clarity , GENIUS Act progress. If this upgrade clicks, America’s global currency doesn’t fade—it evolves.

Because liberation—like our ancestors taught us—requires controlling the means of exchange. Whether that’s trade routes, gold reserves, or now: blockchain settlement layers that keep the dollar central while making it unstoppable.

The real question: Are you positioned for the upgrade, or still betting on the old system’s collapse?

What’s your take—controlled extension or wishful thinking? Drop your perspective in the comments below.